Search

The Indian CE industry crossed 1,00,000-unit sales in 2022-2023

Sandeep Singh, Managing Director, Tata Hitachi Construction Machinery, speaks on the growing market for construction equipment in India.

Unleashing the hidden potential

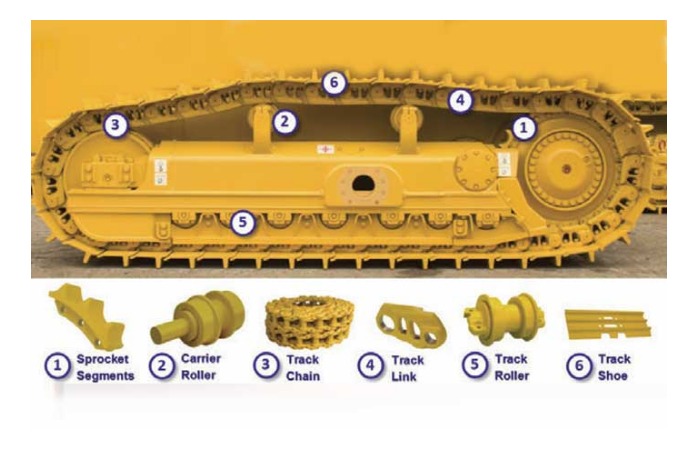

The undercarriage parts market in India is expected to continue growing due to ongoing infrastructure projects, and the demand for reliable heavy machinery.

The outlook for the mining industry is positive for the next two years

Dheeraj Panda, COO – Sales, Marketing & Customer Support, Sany Heavy Duty India, speaks on the outlook for the mining sector in India, and the company’s major products in mining

Mining opportunities!

Government’s thrust on coal mining is expected to significantly impact demand for mining equipment.

What’s driving the demand?

Increasing demand for novel construction equipment is expected to drive the global undercarriage components market in the upcoming years.

Heading towards a new high!

After two years of lull, the excavator market should grow again and reach 25,000 units in 2022.

Opportunities for 45t class excavators are immense

Rahul Shorey National Head – Construction, Tata Hitachi Construction Machinery Company.

In 2022, the market for hydraulic excavators may touch 25,000 units

Last year, the excavator market touched 18,000 units. The start of last year was good. Later on the numbers dipped due to Covid-19 pandemic. However from September onwards, the market picked up.

We expect the demand to grow for hydraulic excavators

Arvind K Garg, Executive Vice-President and Head-Construction & Mining Machinery Business, Larsen & Toubro

New Avenues to Growth

The ongoing COVID-19 pandemic has hit market players adversely on the supply side, causing declining sales of undercarriage components.

Liebherr mining trucks at Australian mine

Liebherr Mining provides five new trucks to MacKellar Mining.

We have a long-term expansion plan for India

Bonfiglioli Transmissions has recently expanded its manufacturing facility in Chennai to double the production in India.

XCMG opens spare parts centre in Mongolia

XCMG has officially opened the company?s first spare parts centre in Ulaanbaatar, Mongolia, on July 23. The announcement is the final piece of XCMG?s supply chain jigsaw in the region and will allow XCMG to provide all-around support and services for customers in Mongolia.

Intelligent Maintenance

Mining companies often go to greater expenses to keep their giant equipment healthy. The cost of achieving the crucial reliability can be reduced considerably through intelligent maintenance.

Marching Towards Century

LiuGong celebrated 60 years of successful presence in the global market and completed production of 400,000 units of loaders in November 2018.

LiuGong celebrates 60 years of global presence

LiuGong?s 60th anniversary celebration was held at LiuGong International Industrial Park in Liuzhou, Guangxi, China. Attendees included domestic and overseas customers, distributors, suppliers, government officials, shareholders, and stakeholders who have worked with LiuGong throughout its 60 years.

We offer much more than just the live auctions

Ritchie Bros is one of the largest equipment platforms worldwide, transacting hundreds of thousands of items each year. Eduard Faig, Regional Sales Manager, Middle East, Africa and Asia Subcontinent, Ritchie Bros elaborates on the company's presence in the global market and its future plans for India.

We aim to achieve 10 per cent market share in wheel loaders

While Tata Hitachi is maintaining itself as the market leader in excavators in India, the company is aiming to have a decent market share in wheeled equipment segment also. Sandeep Singh, Managing Director, Tata Hitachi Construction Machinery Co, shares more about the market and the company's plans.

Hitachi to introduce New mining excavators

The new EX-7 series mining excavators are set to hit the global marketfrom April 2019.

Hitachi Construction Machinery to introduce new mining excavators

Hitachi Construction Machinery Co announced the development of their EX-7 series, a new generation of mining excavators set to hit the global market from April 2019.

ON THE CLOCK!

Material and earth movements are the major work content of all infrastructure developments and mining activities. Front-end loaders, backhoe loaders, dozers and application-centric equipment as options for the users to choose from to suit individual requirements.

Large Miners Forward

While the global mining industry is on the decline, India is witnessing a reverse trend. Many international mining equipment manufacturers are showcasing their products at BAUMA 2016, Germany, in a big way, at a time when Coal India

We cater to Delhi NCR, Uttaranchal, UP and Haryana markets

Apart from Volvo and Powerscreen, we would like to add at least one more business having Synergy with our existing range of products in construction and mining segment, says PK Shivpuri, Head - Sales Operations, Alpha Technical Services.

Liebherr is investing in skilled personnel and adequate warehousing

Our prime focus is on R9100 which is a 100-tonne class excavator which we will launch here in 2012. For large mining excavators from 26-42 cu m, we will be waiting for a perfect opportunity to launch in India, says Koenig Holger, Director, Liebherr India. 1 - -

23450 14 162 2012-01-01 00:00:00.000 Equipment India We see huge potential for tower crane business We are not only improving the productivity efficiency and effectiveness of the tower crane domain, but also improving the safety aspect on a human angle," says Rajesh Sharma, Vice President, Marketing, Escorts, in an exclusive chat with Equipment India. Excerpts from the interview.

How do you look at the performance of the Indian construction equipment market in 2011?

Definitely, 2011 is a growth year if you compare it with the sales in 2010. In 2010, the industry size all put together was about Rs 16,500 crore and in 2011 it is about Rs 18,500 crore. In that way growth has happened. Now the growth will not be seen for all kinds of equipment. Equipment market is a derived market. It depends on the activity. If there is a particular kind of activity which suits particular kind of equipment then that equipment will sell more in that year. So I would say that the growth rate has been in the range of 10-25 per cent across the equipment spectrum.

How did Escorts perform in 2011?

Our fiscal is from October to September, during which, we have grown by 41 per cent. The growth has been across the product spectrum. If look at it all the num?bers have grown and growth has been achieved holistically. If take individually, compactors segment has remained stagnant and very limited growth has happened because road activity was slow. All the rem?aining segments have grown beautifully.

Could you describe the partnership with Linden Comansa?

This partnership is an year old now. Last year, we had signed exclusive distribution agreement with them for Indian market. They are the mentors for tower cranes and our strength of distribution and developing skills in the market matched quite well.

What made you to venture into tower cranes?

In terms of growth opportunity we see a huge potential for tower crane business both in the real estate segment as well as industrial infrastructure. Real estate inve?stment is $16 billion which we think will go up to $24 billion by 2015. And industrial infrastructure is largely on the power side. A lot of activity will happen on nuclear power plant and hydel plant and these kinds of cranes are required. The usual small cranes cannot do the job. So believing this and looking at what happened across the world we thought there was huge potential for this and is why we entered tower crane business.

We are partners with Linden Comansa because they are the most technologically innovative company around. There was a lot of gap between what is available in India and what the world was using. Currently, the use of tower cranes is much lower and much basic in terms of technology. Flat top is what the world is getting towards so this was the right product to get into.

You said this partnership is not just for business sake but for solution providing. Kindly explain.

As a responsible supplier who has been known to be a pioneer in some field or other, it is our responsibility that we always try to push technology datum enveloped in the industry towards upward. This is one step towards that direction. We are not only improving the productivity efficiency and effecti?veness of the tower crane domain, but also improving the safety aspect on a human angle.

What kind of business are you looking at in the coming years?

We have already taken sizeable chunk of high-end market in the very first year. But the numbers have been really low like the size of high end market is small. By 2015 we want to sell about 200 machines. Construction equipment industry in the last ten years has been doubling itself every fourth year. Even if you see 250 numbers doubling to 500-600 numbers and we are aspiring for 200 numbers is not out of sync.

What is the advantage of these cranes as far as investment is concerned?

It is a product which has a very long life of 30-35 years which is exceptional in the construction equipment, so you can amo?rtise your investment over a longer period of years. The kind of rental market for tower cranes hardly exists in the country. But, if other assets get about 4 per cent a month, this will get 6 per cent rental a month in the market. Return on investment for a small hirer who is buying this equip?ment also makes it an economic case.

What are your plans to take this initiative forward in the coming years?

As far as the Escorts-Komansa tie-up is concerned, we need to focus more on communicating the technological adva?ntage and translating the equipment advantage into real perfo?rmance. That will happen by training people. That is why I declared that from December onwards we will be having a new training vertical in our school in Bengaluru which will be focussing only on tower cranes. Other products are happening but the new verticals will be open for tower cranes where we will be training people for operation maintenance and the optimum utilisation of the asset which is very important. We have already sent people for training and they have been trained by them and these are the people who will train them further.

How important is trained manpower?

We have emphasis on training. It is not only done for leveraging the marketing but also helping the industry and the country. Every business runs on what you are doing for the customer. If you are distributing well and you are having trained manpower in the country you have done great service to the customer. Equipment hardware is very easy to make. These two aspects are very important.

How do you see the competition in tower cranes?

There are already 12 players for tower cranes. But most of them are competing for the lower segment of the market. To be a player of a high segment, you need technological depth which they do not have. They have seen a Chinese crane and they made it and are selling in India. That is not going to do much favour in the long term. In the long term you need technological depth and innovativeness in terms of creating a shift from product selling to solution selling. This is entirely about solution selling.

How is the rental market for these cranes?

Hiring segment in the country is very decentralised and fragmented. Only two companies of large size are operating in India but they are not very effective. We have large populous of customers who are buying one or two equipment and are working in the close proximity and locality. They are not pan-India players. So Indian hiring industries are not organised as what we see in Europe and the US. When you have such a scenario people tend to invest in those

assets which are not high in value. Tower crane hiring will take some time to come around.

The high initial cost and then it is giving returns for 30 years and they are not mobile equipment. So these small hiring companies may no tend to get into it immediately. But as the time comes it will increase more and more. They buy assets depending upon what is demanded by the market.

What are your plans for 2012 and beyond?

Last year we achieved about 40 per cent growth and this year we are aiming at bettering that. We are very hopeful that we will be able to do that. We have a lot of new products in our armour both on the manufacturing and training site and I am sure we will be able to do that.

Are you planning to venture into other equipment segments?

We have a lot of opportunity in the verticals what we operate in. In crane side we almost have everything. On road construction side we only have compaction equipment and now we have added motor graders. There are many more we can add in that segment. Similarly moving north side we have backhoe loader. There are many products where we are not there and we can get into that later.

+91-22-24193000

+91-22-24193000 Subscriber@ASAPPinfoGlobal.com

Subscriber@ASAPPinfoGlobal.com